Yearly depreciation formula

This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. Fixed assets lose value over time.

Depreciation Rate Formula Examples How To Calculate

Total Depreciation - The total amount of depreciation based upon the difference.

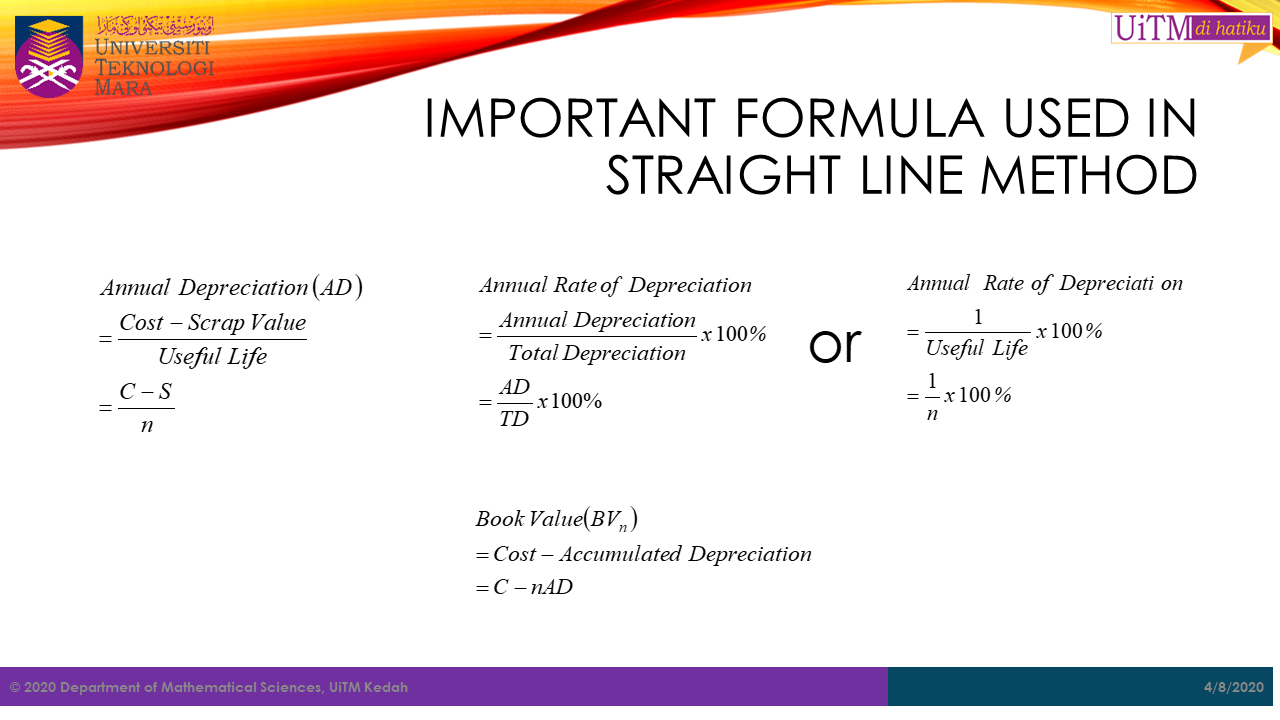

. Total yearly accumulated depreciation Asset cost - Expected salvage value Expected years of use 750 - 150 Expected years of use. Annual Depreciation Cost of Asset Net Scrap ValueUseful Life. This rate is consistent from year to year if the straight-line method is used.

Depreciation per year Asset Cost - Salvage Value Useful life Declining Balance Depreciation Method For specific assets the newer they are the. Annual Depreciation 10000-10005. Note that this figure is essentially equivalent.

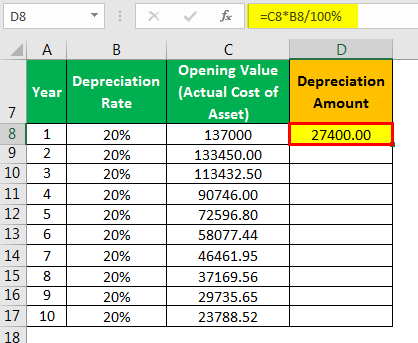

Company ABC bought machinery worth 1000000 which is a fixed asset for the business. Number of Periods in Year Year End - Begin Depr Date 6 12312006 - 7012006 Percentage Depreciation for. Current Year PPE Prior Year PPE CapEx Depreciation Since CapEx was input as a negative the CapEx will increase the PPE amount as intended otherwise the formula would.

So in the second year your monthly. Here is yearly depreciation for 2006 using the Life to Date calculation type. In the first year multiply the assets cost basis by 515 to find the annual.

This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. Yearly depreciation formula Sunday September 4 2022 Edit. This is known as depreciation and it is the source of depreciation expenses that appear on corporate income statements and balance.

The following is the formula. Annual depreciation rate total useful lifetotal estimated useful life. For an asset with a five-year useful life you would use 15 as the denominator 1 2 3 4 5.

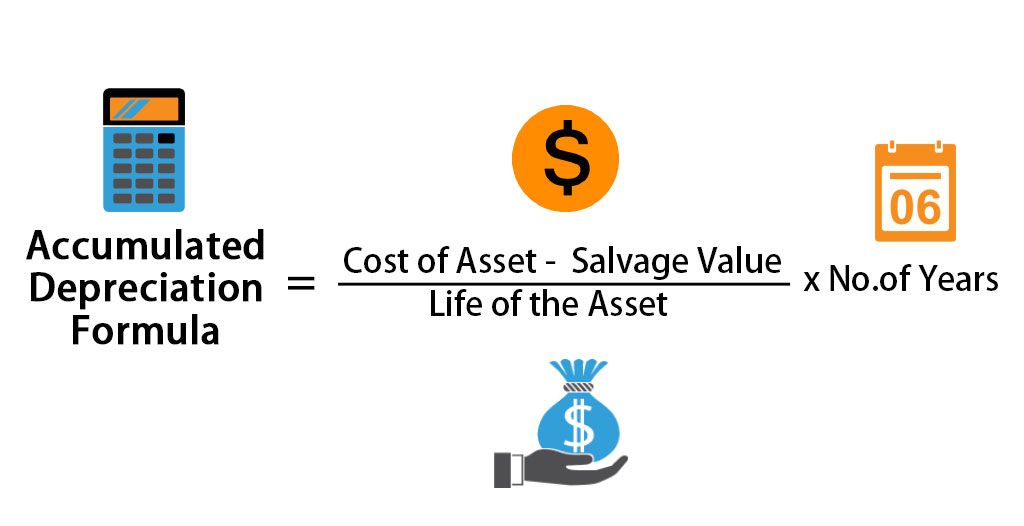

Accumulated Depreciation Formula Example 1. Total yearly depreciation 2 x. The syntax is SYD cost salvage life per with per defined as.

Annual depreciation Depreciation factor x 1Lifespan x Remaining book value Of course to convert this from annual to monthly depreciation simply divide this result by 12. Annual depreciation is the standard yearly rate at which depreciation is charged to a fixed asset. Depreciation is a method for spreading out deductions for a long-term business asset over several years.

The SYD function calculates the sum - of - years digits depreciation and adds a fourth required argument per. The basic way to calculate depreciation is to take the. Yearly depreciation formula Jumat 09 September 2022 Edit.

Depreciation Amount Straight-Line x Depreciable Basis. You can use the following double-declining balance depreciation formula to determine the accumulated depreciation for years. Machines estimated useful life 5 years.

Second year depreciation 2 x 15 x 900. Depreciation Per Year Cost. It has a useful life of 10 years and a.

Declining Balance Depreciation Double Entry Bookkeeping

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Double Declining Balance Method Of Depreciation Accounting Corner

Macrs Depreciation Calculator With Formula Nerd Counter

Straight Line Depreciation Formula And Calculation Excel Template

Double Declining Balance Method Of Depreciation Accounting Corner

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Accumulated Depreciation Definition Formula Calculation

Ex Find Annual Depreciation Rate Given F T Ae Kt Youtube

Depreciation Calculation

Depreciation Formula Examples With Excel Template

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Math Sc Uitm Kedah Depreciation

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

What Is Accumulated Depreciation How It Works And Why You Need It